VAT Road Fuel Scale Charge

Accounting for VAT on road fuel. There are 4 options (this is from HMRC on 14th September 2009). Pick only 1 of them.

Option 1: Claim all the VAT because 100% is used for business purposes (no need to read any further)

Option 2: Claim no VAT (no need to read any further)

Option 3: Keep detailed mileage records of total mileage and those for business trips and only claim for VAT used for the business mileage. This is an equation to work out the figures. Here’s an example. Total miles: 4000, of which 3000 are used for business (record the date, route and mileage of each business trip). Total inclusive cost of all fuel = £400.

- The cost of the business mileage is £400 x 3000/4000 = £300

- Work out the total cost of the private mileage: £400 - £300 = £100

- Assuming you have been entering all transactions including VAT, you will need to pay back the private mileage costs and VAT.

- Make a purchase transaction using negative numbers with a VAT Date for the current period. In this example, enter -100 in the Total Amount column and apply the Standard rate VAT code (at 15% the VAT will be £13.04). The From account will be cash (or your personal loan account) and the To account will be Motor (or whatever account you have been using to record road fuel expenses).

Option 4: Claim all the VAT and use the Fuel Scale Charge to account for private use. This is the most common case.

- Enter all your road fuel expenses in full including the VAT

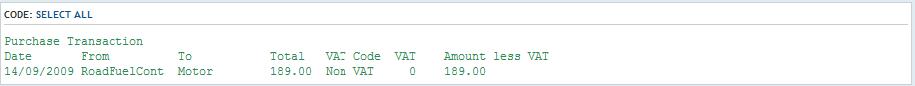

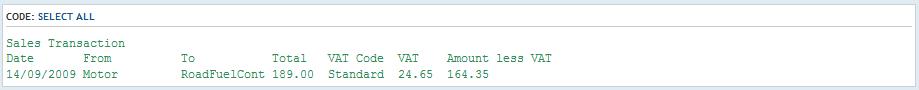

- At the end of each VAT return period make 2 further transactions. You will also need to open a ‘Road Fuel Control Account’ (in Assets > Current Assets of type Cash Account so it is available everywhere). This account should always end up with a zero balance. If it’s not zero, you have made a mistake somewhere. This example is based on a vehicle with a Co2 rating of 135 over 3 months.

Note that the 1st transaction is a Purchase, but the 2nd is a Sales Transaction. To enter the sales transaction you will need to allow the Motor Expense account to be included in Sales. Double-click the (Chart of Accounts > Equity > Profit and Loss > Expenses >) Motor account so it opens in the panel on the right. Select the Properties tab at the bottom. Tick the Sales From option in there.