Online VAT Submission History

Introduction

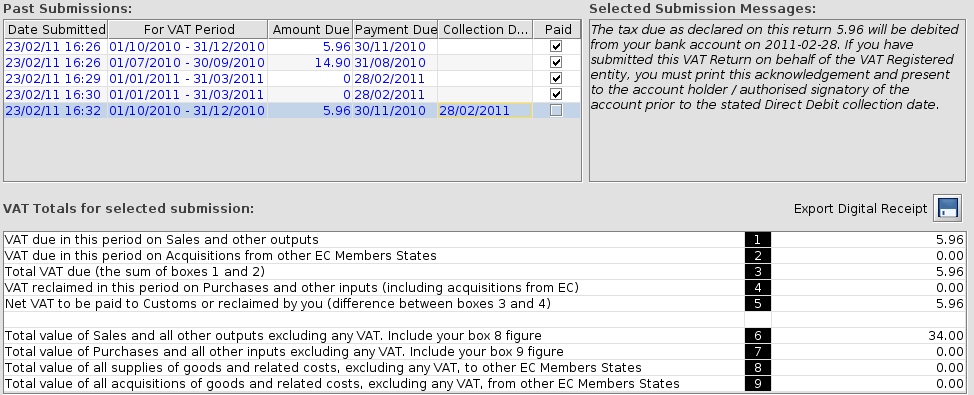

The ‘Online VAT Submission History’ screen shows you all successful on-line VAT submissions you have made using Business Accountz.

This screen allows you to see all the related information about a VAT submission including:

- The amount due for payment

- The due date

- The date the payment will be taken if you have a Direct Debit set-up

- Any additional messages received from HMRC

Screen Layout

Past Submissions

This table list all the successful on-line VAT submission made using Business Accountz in chronological order. There are six columns:

- Date Submitted -The date the submission was made

- For VAT Period -The start and end date of the VAT period submitted

- Amount Due -The total amount owed to HMRC for the period

- Payment Due -The due date for the payment

- Collection Date -The date the amount due will be taken if you have a Direct Debit set-up with HMRC for that period

- Paid - A user controlled flag that lets you record if you have made the payment to HMRC for the given period.

Selected Submission Messages

This text area displays any messages that were received from HMRC for the period currently selected in the Past Submissions table

VAT Totals for selected submission

This table shows you the calculated figures that were submitted to HMRC for the period currently selected in the Past Submissions table

Export Digital Receipt

This button allows you to download the HMRC digital receipt received for the period currently selected in the Past Submissions table. You may want to store these receipts somewhere for your future records.

This button allows you to download the HMRC digital receipt received for the period currently selected in the Past Submissions table. You may want to store these receipts somewhere for your future records.