EC Acquisitions VAT Boxes 2 and 4

If you have bought goods from another EC country and they have accepted your VAT number and not charged VAT, then you need to account for it by making two Purchase Transactions.

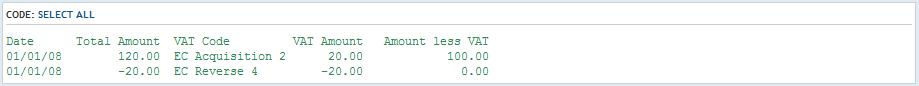

The example used here is for £100. This is the total you have paid them, there is no VAT in this, so you will need to add on the VAT so it appears in Box 2 of your VAT return, then take it off again so it appears in Box 4 (yes VAT EC Acquisition rules are crazy and an amazing waste of time, but we have no choice).

Transaction 1. Enter the date, from and to accounts as normal. Enter the invoice total in the Amount less VAT column (eg. 100.00). Use the EC Acquisition Box 2 - 20% option in the VAT Code and press Enter. The VAT has now been calculated for you and added on.

Transaction 2. This removes the VAT again. Make an identical entry to the first transaction except enter the VAT element directly into the Total Amount field with a minus sign in front (eg. -20.00). Enter the EC Reverse Acquisition Box 4 option into the VAT Code field. You will see that the Amount less VAT column shows zero, and that is it. Nothing else to do.

Here is the finished example of both transactions:

Note you may need to manually edit the VAT Amount so it is the same as the Total Amount for the second transaction.