Construction Industry Reverse Charge notes

Here are some links you may find very helpful:

Worked Example

Entering a subcontractor bill of £5000.00 where reverse charge has been applied:

I have created a new Creditors account for this (this account should be made visible in all books by ticking the show in boxes) and suggest that you use this in future for reverse charge bills.

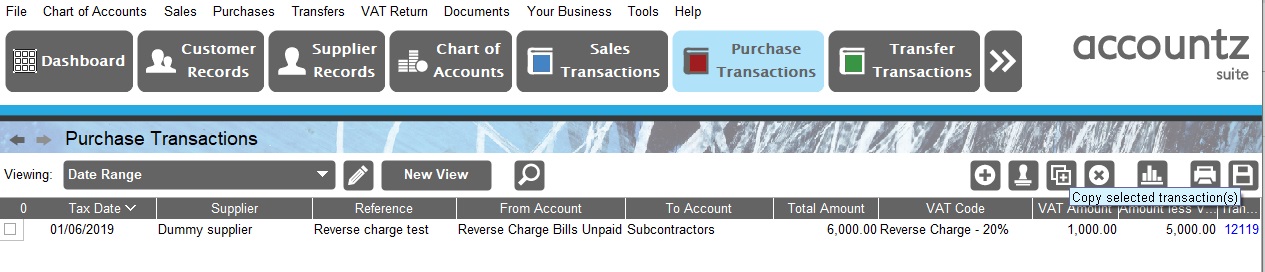

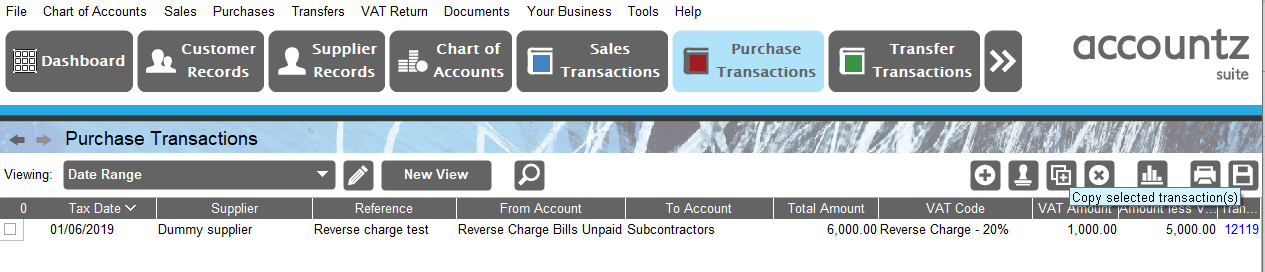

The bill has to state the amount of VAT that the reverse charge has been applied to. Enter a purchase transaction from the new creditors account which I have called Reverse Charge Bills Unpaid To Subcontractor the total amount is 6000.00 with a VAT code of Reverse Charge and the VAT amount entered as per the bill. See this screen shot:

This transaction places the 1000.00 in VAT box 4 on your return and 5000.00 in box 7

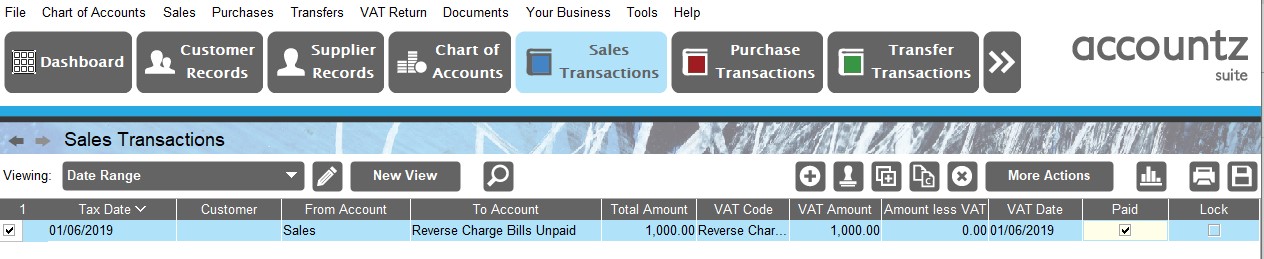

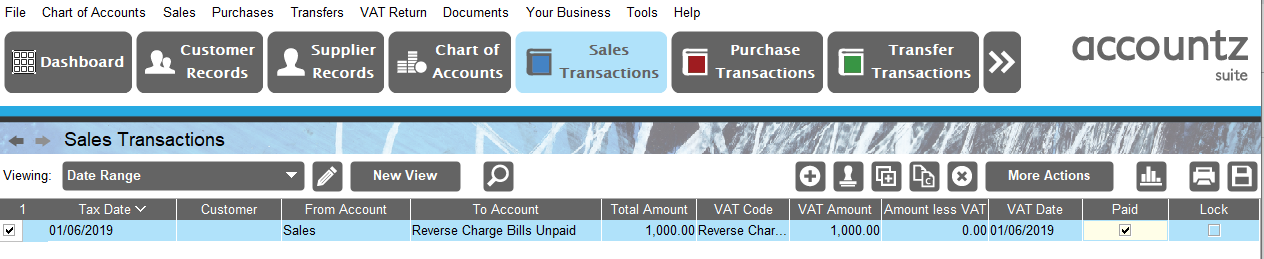

A Sales transaction has to be entered to show the reversal of the VAT. This should be entered From (any sales account as this will not affect your sales totals) To Reverse Charge Bills Unpaid with a VAT code of Reverse charge VERY importantly you will have to enter the total amount of 1000.00 in the VAT Amount column and total amount. See this screen shot:

Note I have not entered a customer but you can create one if you wish.

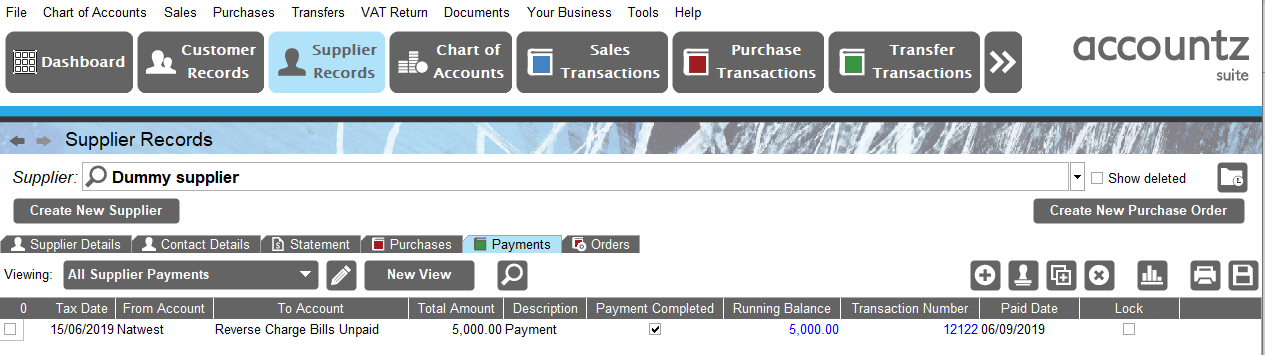

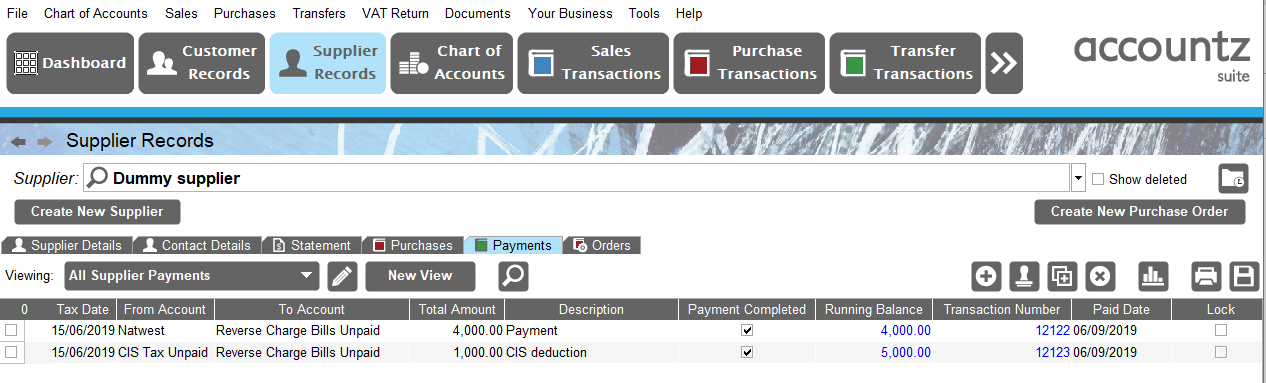

When you pay the bill enter the following Transfer/Payment and mark all transactions payment complete:

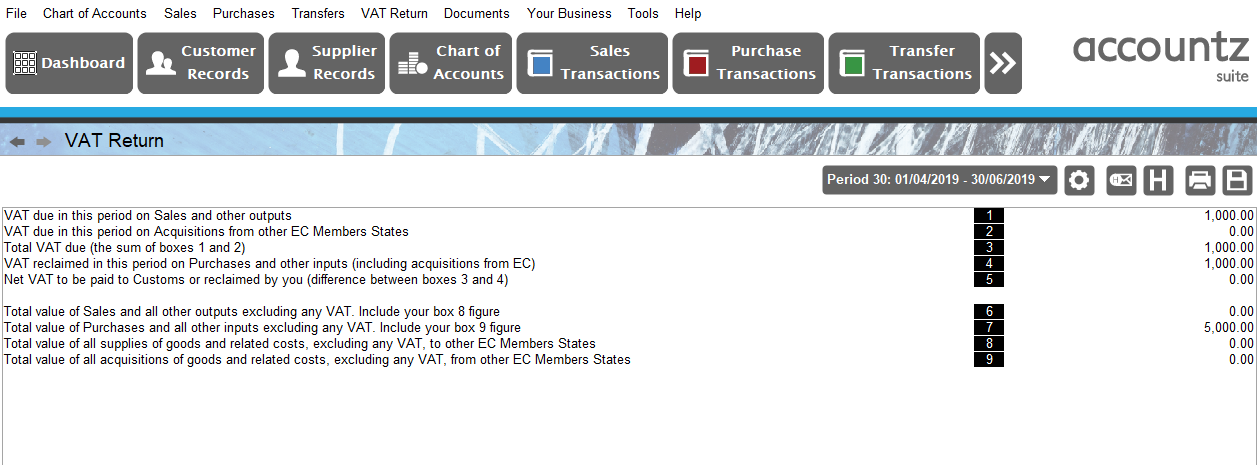

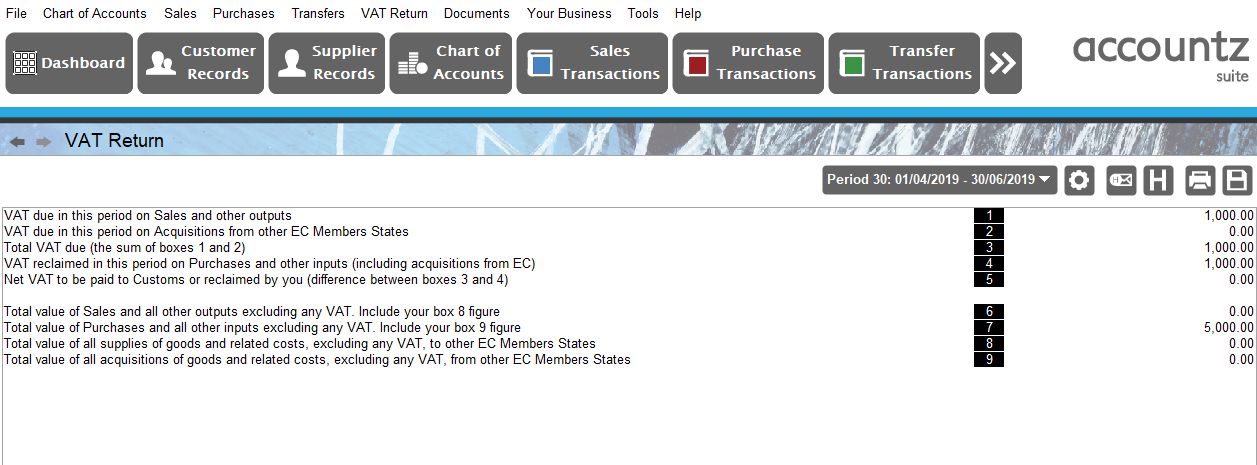

Results of these entries on VAT return:

Entering a subcontractor bill of £5000.00 where reverse charge has been applied and a CIS deduction:

The Purchase transaction is entered the same way as above:

The Sales transaction is also the same:

The Transfer or Payment is entered as follows:

The VAT return is again not changed:

Sales Invoicing

Once you have established which of your sales are affected by the Reverse Charge then your sales transaction should be entered using the Reverse Charge VAT code but make sure that the VAT amount is overwritten with 0.00.

Invoice template should now include this text:

- A note to confirm that his customer must deal with the VAT, along the lines of: “Reverse charge: Customer to pay the VAT to HMRC”

- And either the amount of VAT that the customer will declare as the reverse charge (£2,000), or at least the rate of VAT for the work in question (20% in this case).

I would consider adding to your invoice a custom field so that you can enter this when entering your transactions.