Postponed VAT Accounting (PVA)

Please see these links to HMRC regarding Postponed VAT Accounting (PVA):

How to enter in Business Accountz

To enter your PVA transactions in Business Accountz Suite or Startup Kit VAT we have created a new Easy Step.

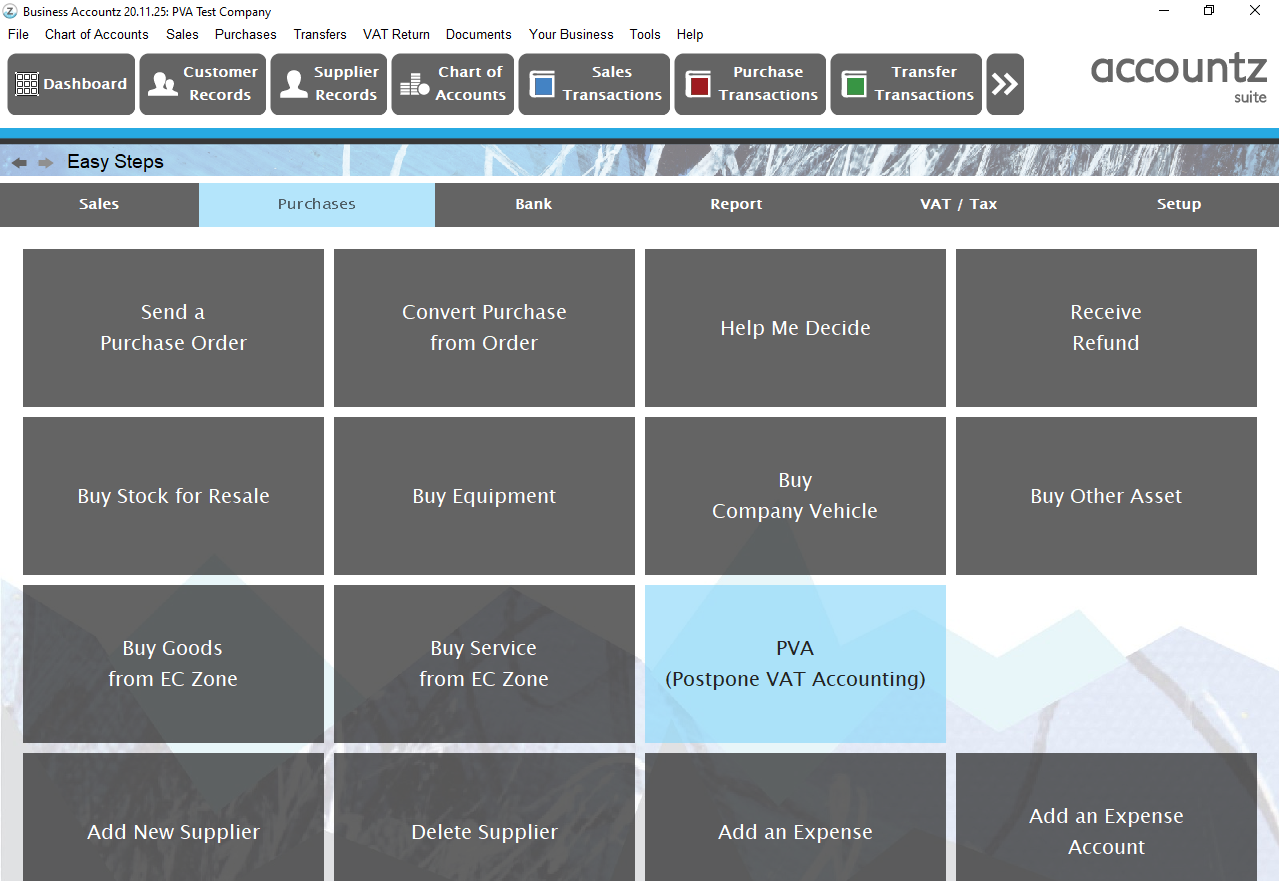

Click on the Easy Step button or on File > Easy Step

Click on Purchases > PVA (Postponed VAT Accounting)

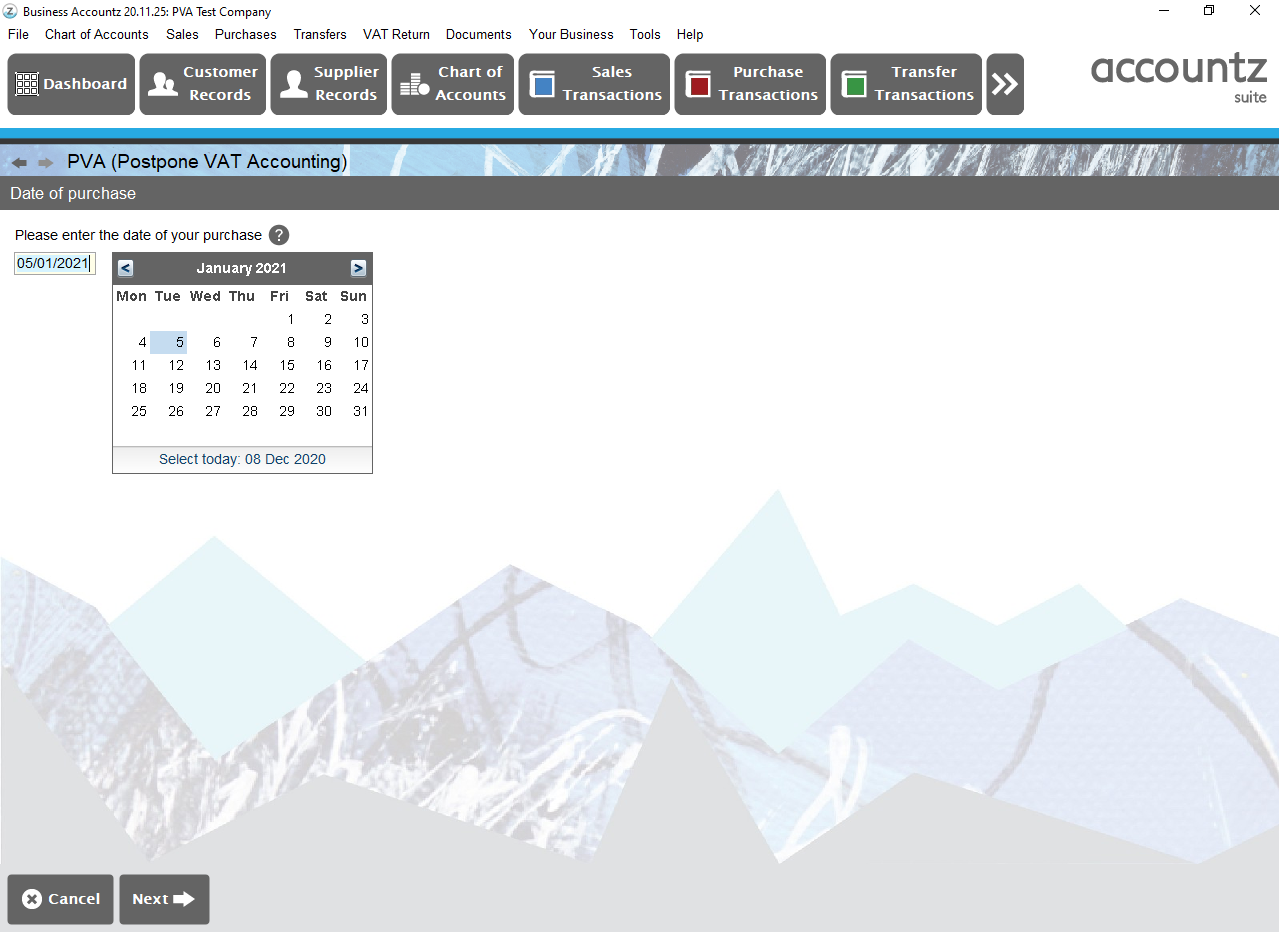

Follow the steps in the wizard:

Step 1 Select date

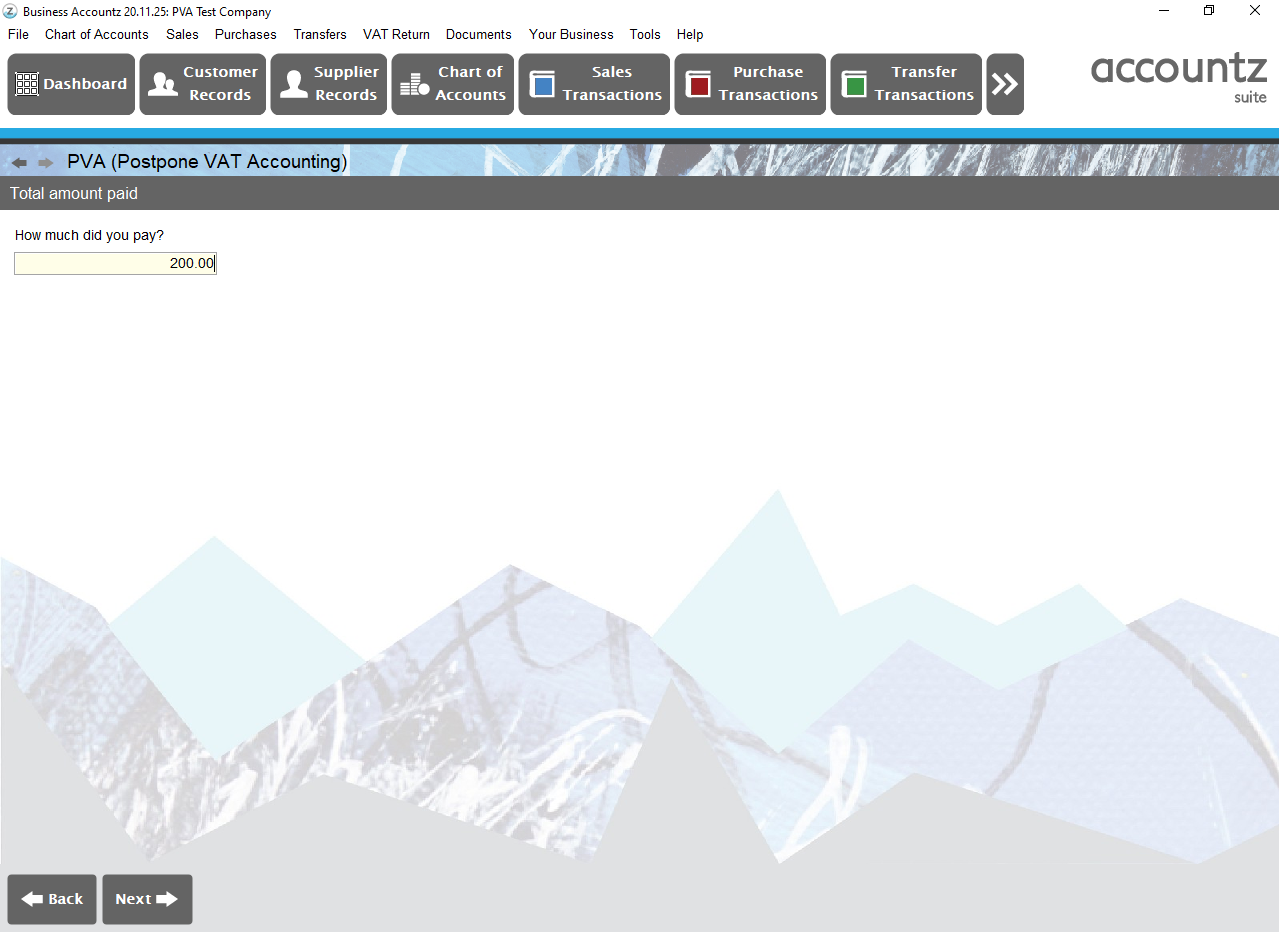

Enter how much you paid for the imported goods in GBP

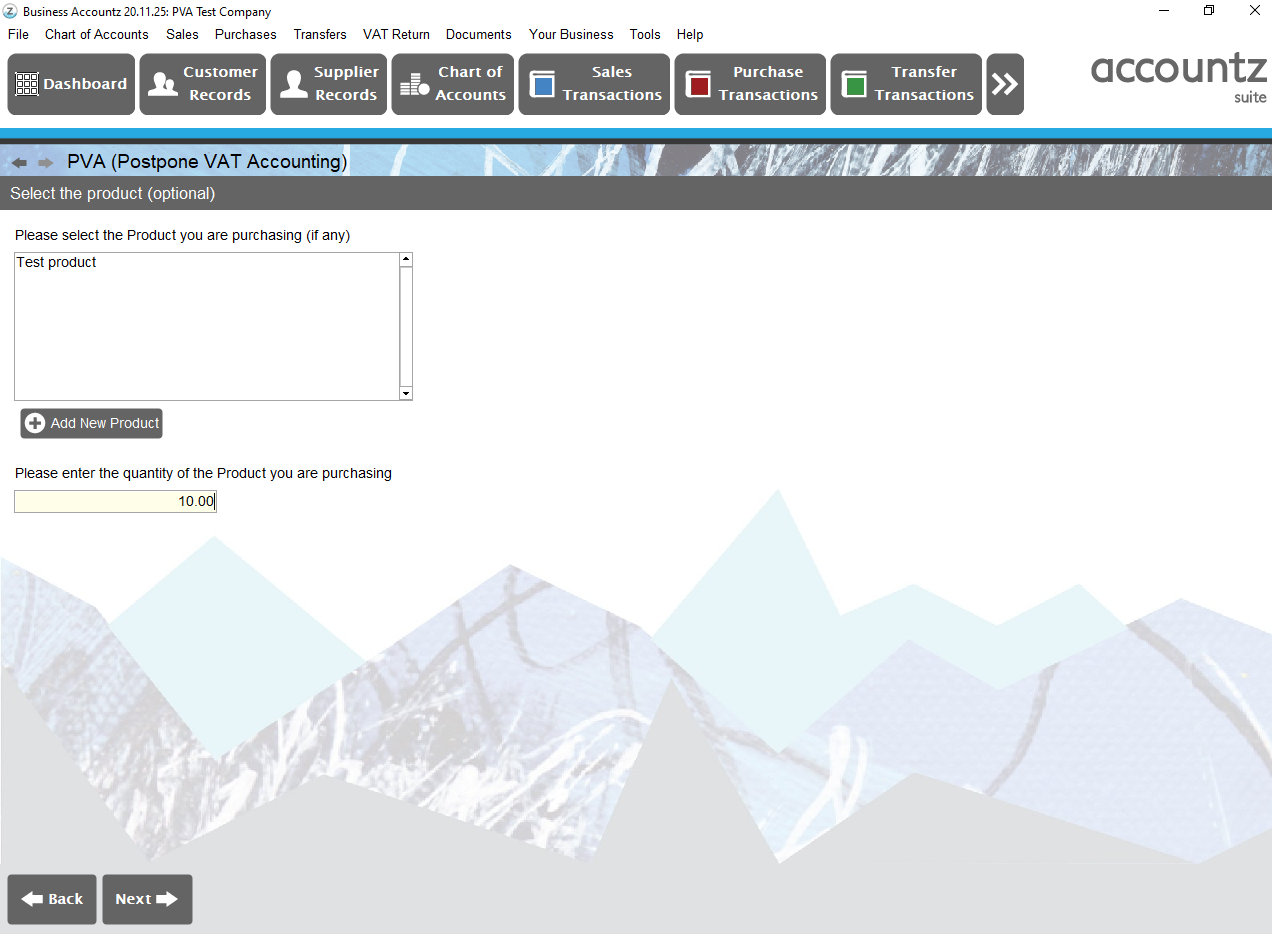

Continue answering the questions. If you are purchasing goods and equipment you can also select a product and quantity during the Easy Step:

Carry on with the Easy Steps filling in how you paid for the items, the supplier and the account that these should be posted to for instance Stock Bought Asset.

You can enter a Description, Reference and Notes

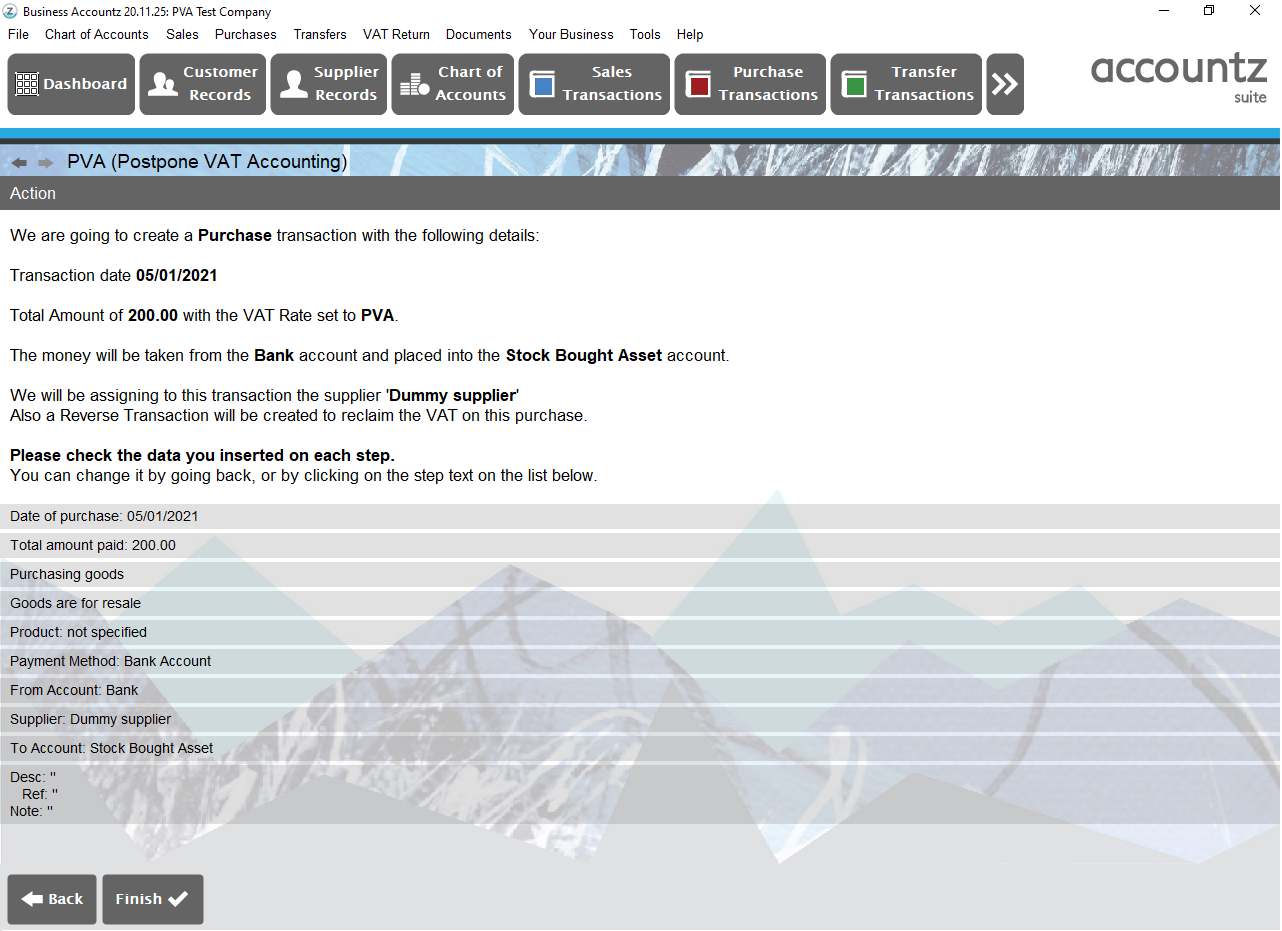

You are then shown a preview of your data and can press Finish

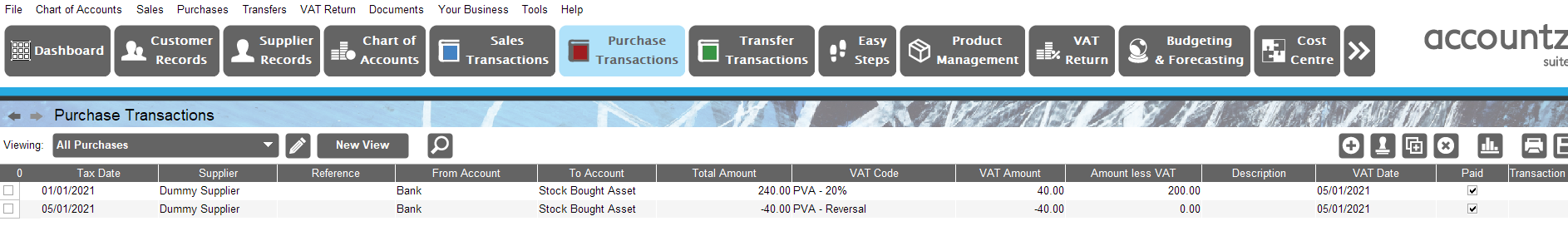

This will then take you to Purchase Transactions where you will see the following:

If you need to adjust your PVA transactions as per your Monthly postponed import statement you can manually enter your transactions by entering the adjustment figure with the same PVA code and reverse PVA code.