Making Tax Digital

Making Tax Digital (MTD) for VAT is mandatory as of 1st April 2019, this requires all VAT registered businesses with a turnover of £85,000 or above (VAT threshold), to keep their business VAT records digitally and submit their VAT returns using MTD recognised software.

Check when a business must register for MTD

MTD within Business Accountz

The new Making Tax Digital for VAT (MTD) submission component supersedes the old VAT submission component for those affected (although the old component will still be visible).

The current VAT setup will continue to work as before by asking the user the same VAT setup questions (start date, period frequency, accrual or cash) and can be edited from the original VAT submission component (as before).

If you have more than 1 company, MTD setup will need to be completed for each one.

Have your company’s VRN Number (VAT Registration) and the login credentials for HMRC ready.

MTD for VAT Component

To access the MTD component, firstly ensure you are on the latest version by going to Help > Check for updates and installing the latest version.

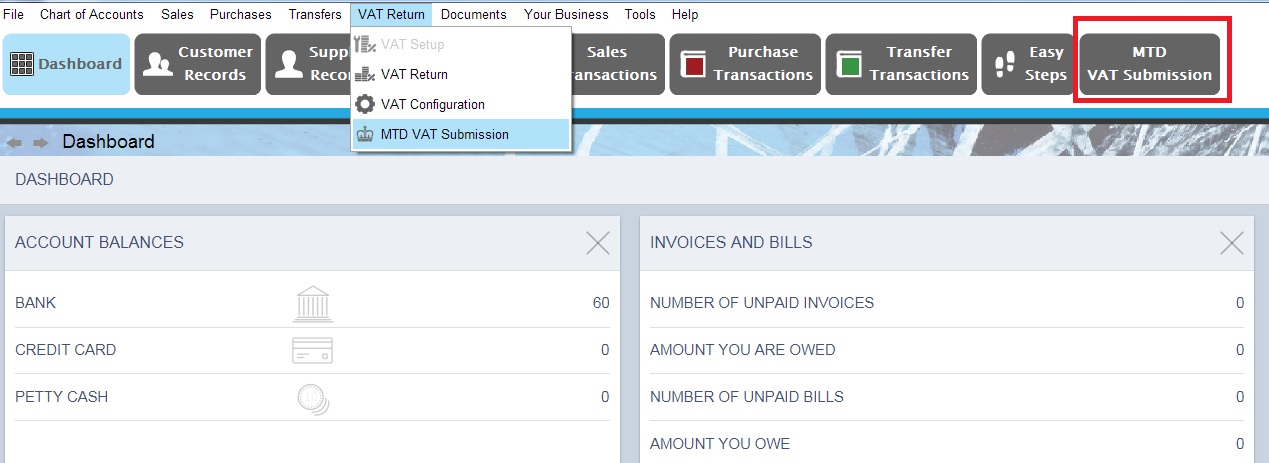

Next, click on the MTD icon or go to VAT Return > MTD VAT Submission

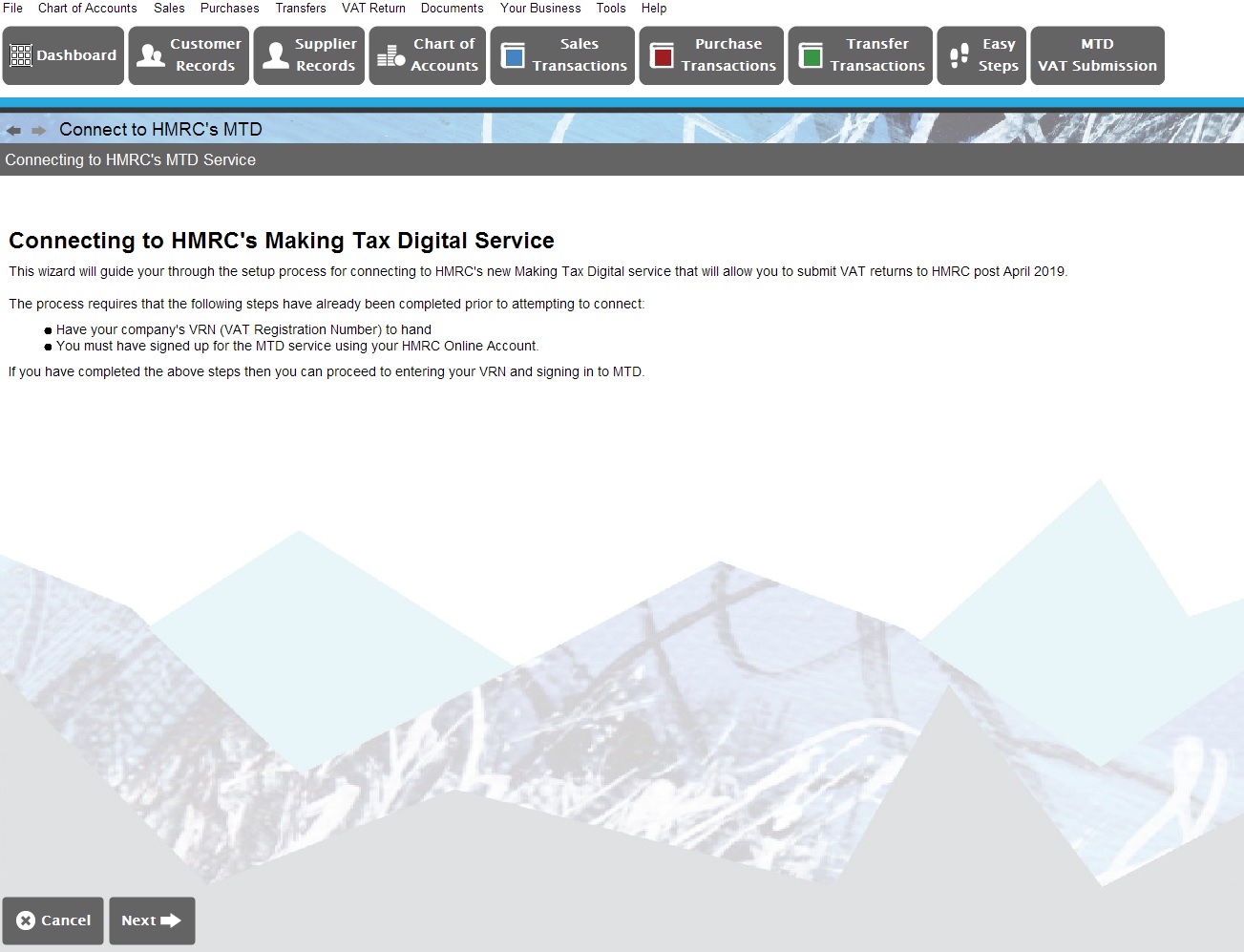

Thoroughly read the text and then click “Next”.

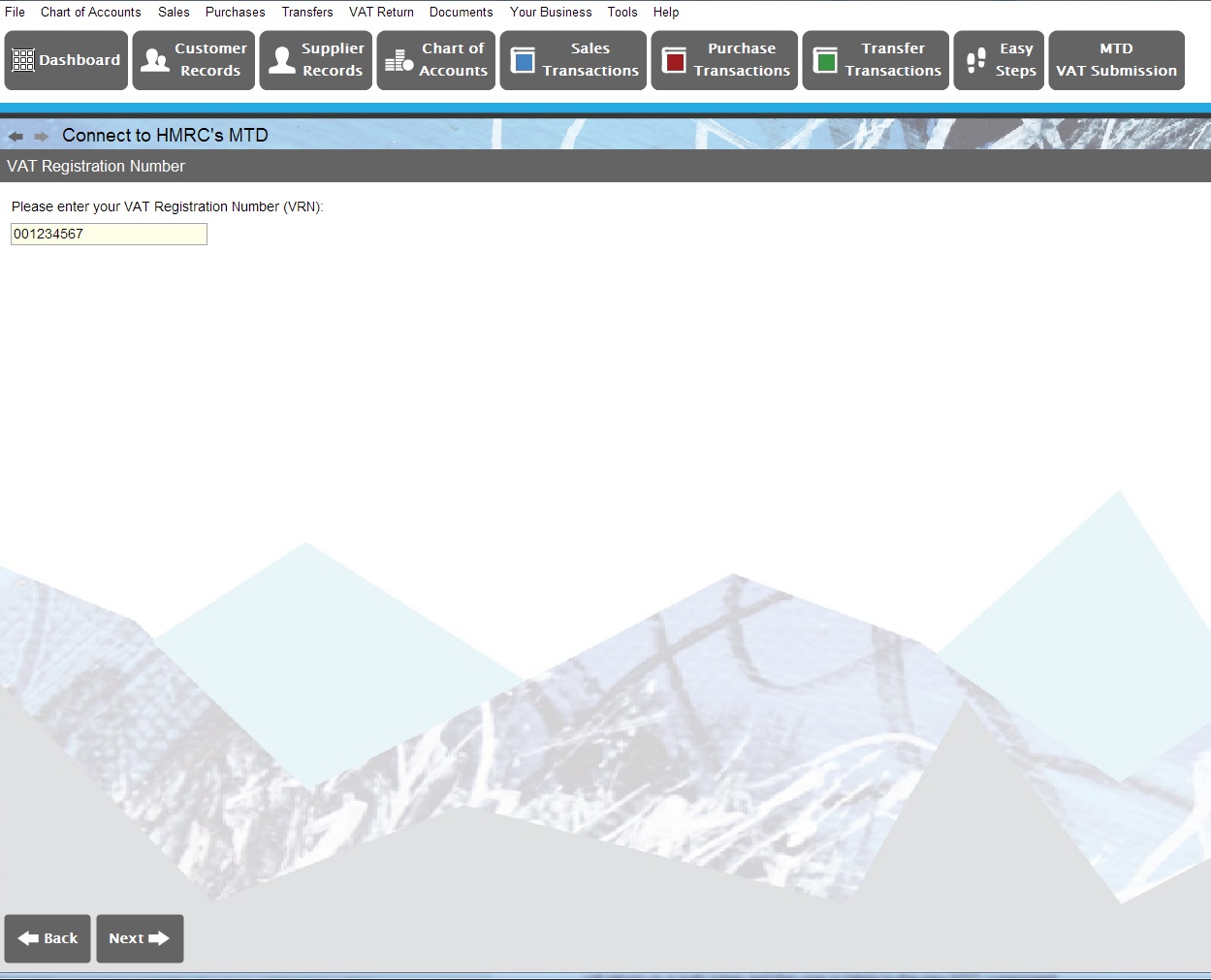

Enter you VRN (VAT Registration Number) when prompted and click “Next”.

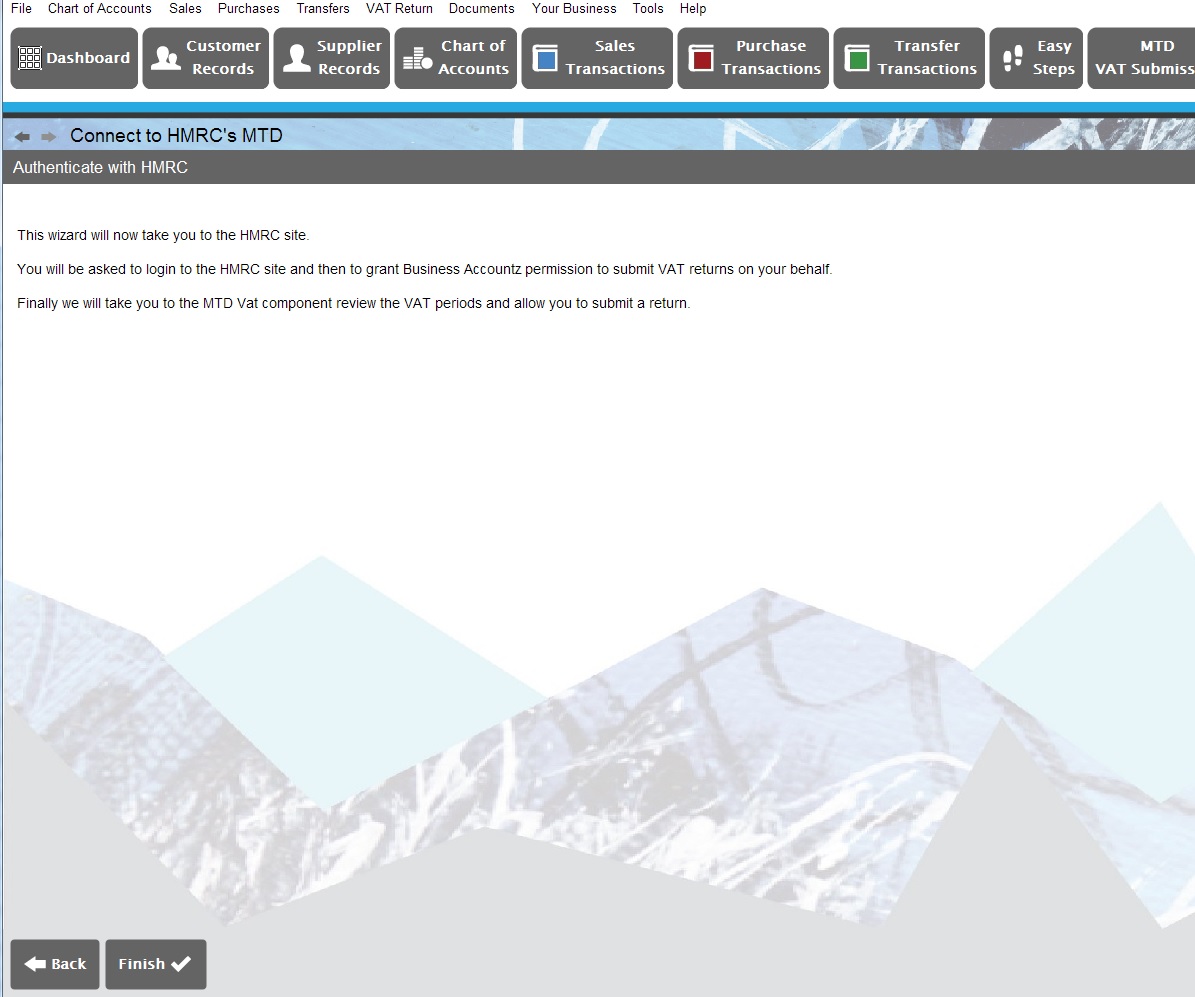

Thoroughly read the text and press “Finish” to confirm you are ready to authenticate with HMRC.

A message will then appear stating your VAT number has been updated and then this:

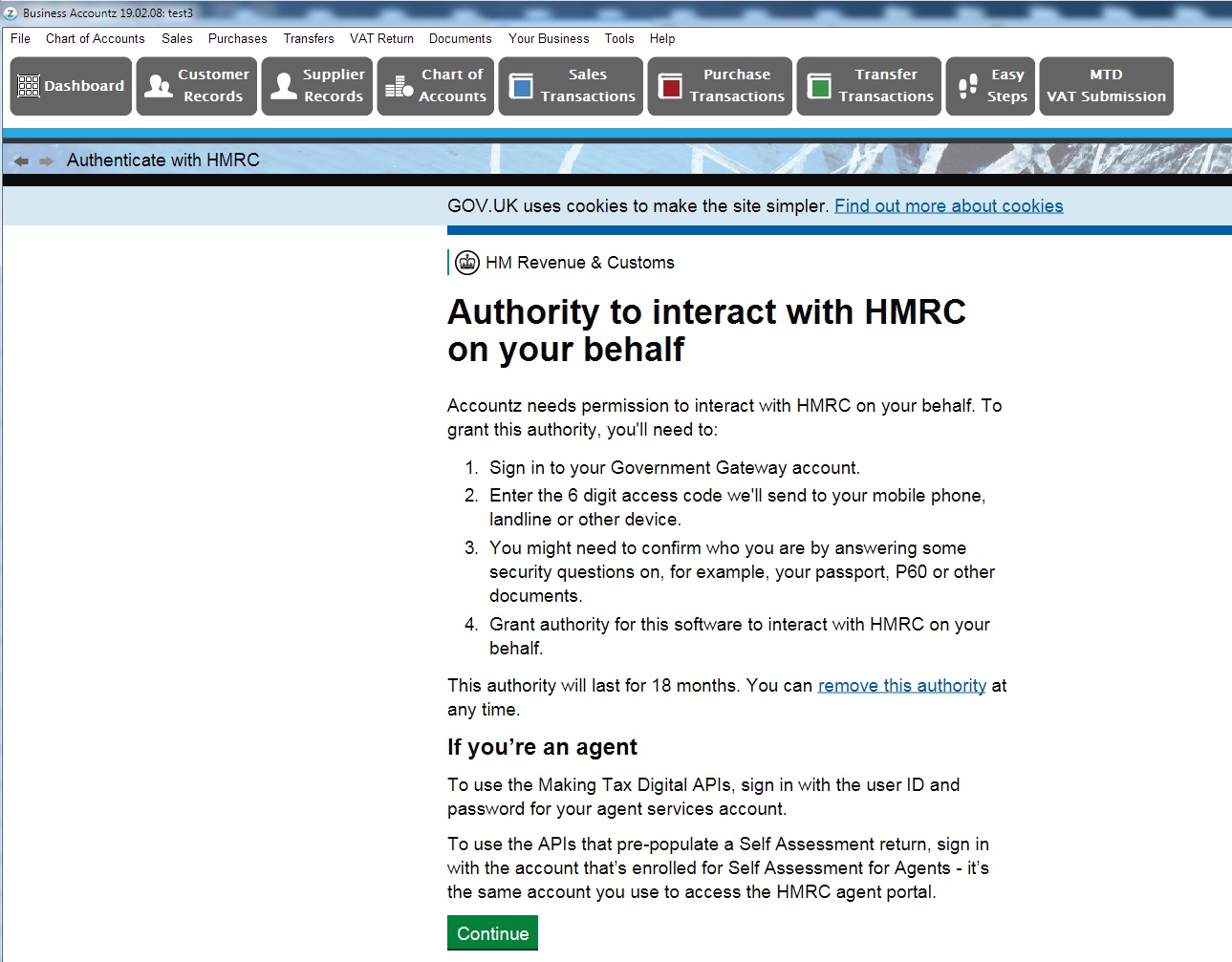

Read the text from HMRC and press “Continue”.

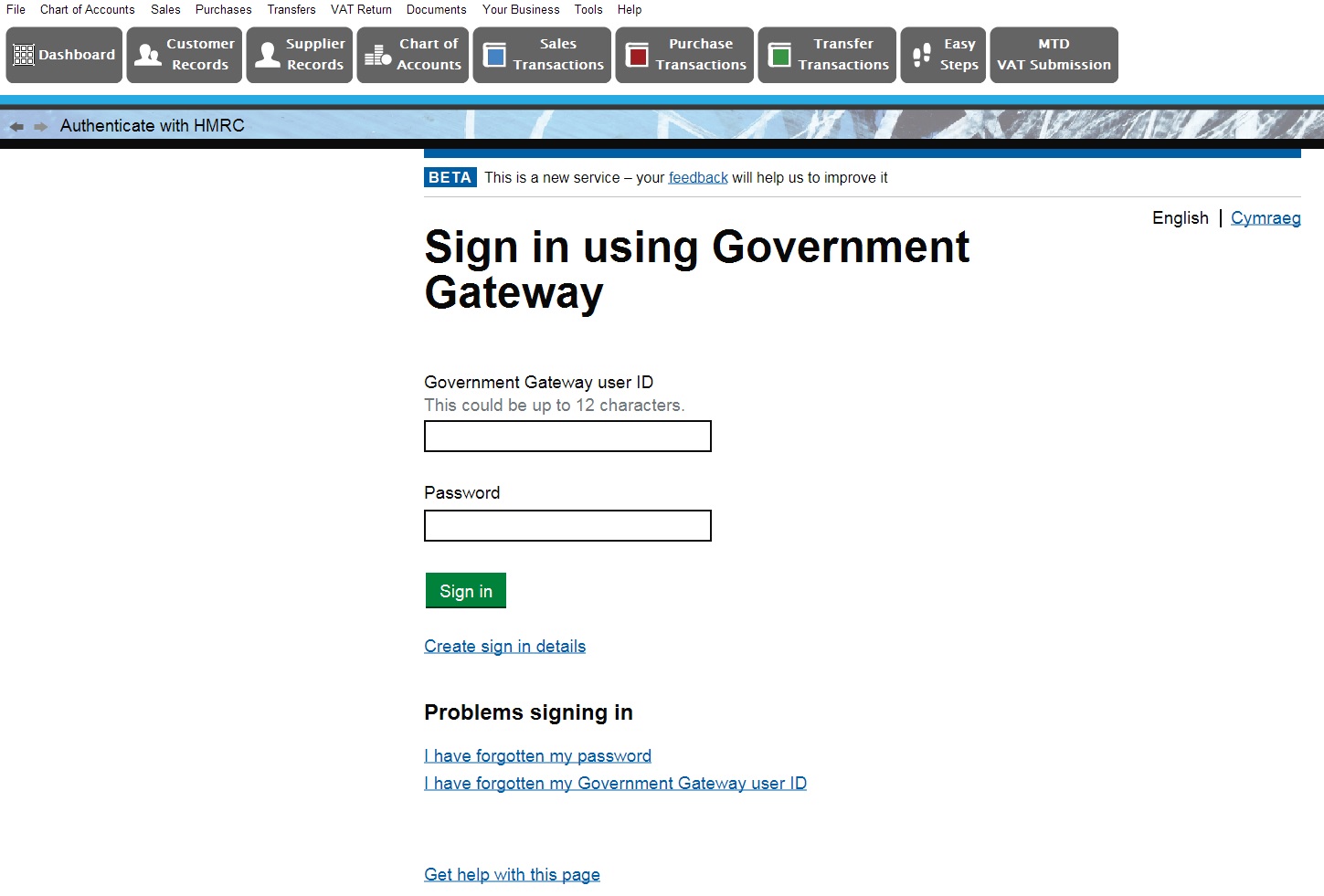

Enter your credentials for HMRC and sign in.

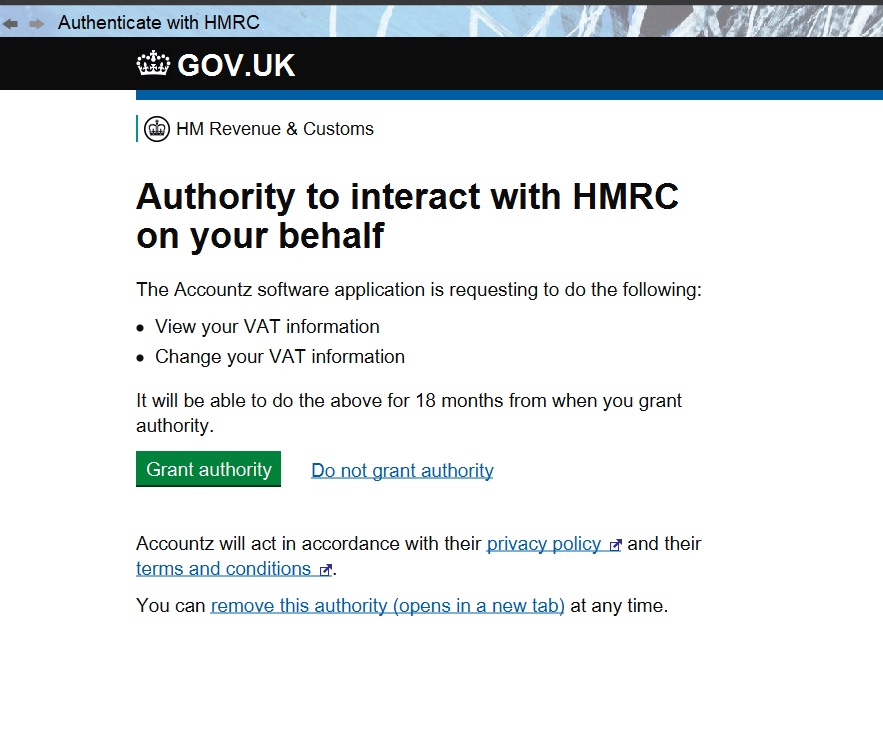

Once authenticated by HMRC, the site will ask you to ‘grant’ the Business Accountz application permission to submit VAT returns on your behalf. NB. If you do not grant Business Accountz this access, you will not be able to submit MTD VAT returns from the software.

Once Business Accountz has been granted authority with HMRC, Business Accountz displays what the businesses’ VAT periods are directly from HMRC (superseding any settings you made during VAT setup).

The above wizard will need to repeated every 18 months or if the program is re-installed or used across multiple computers.

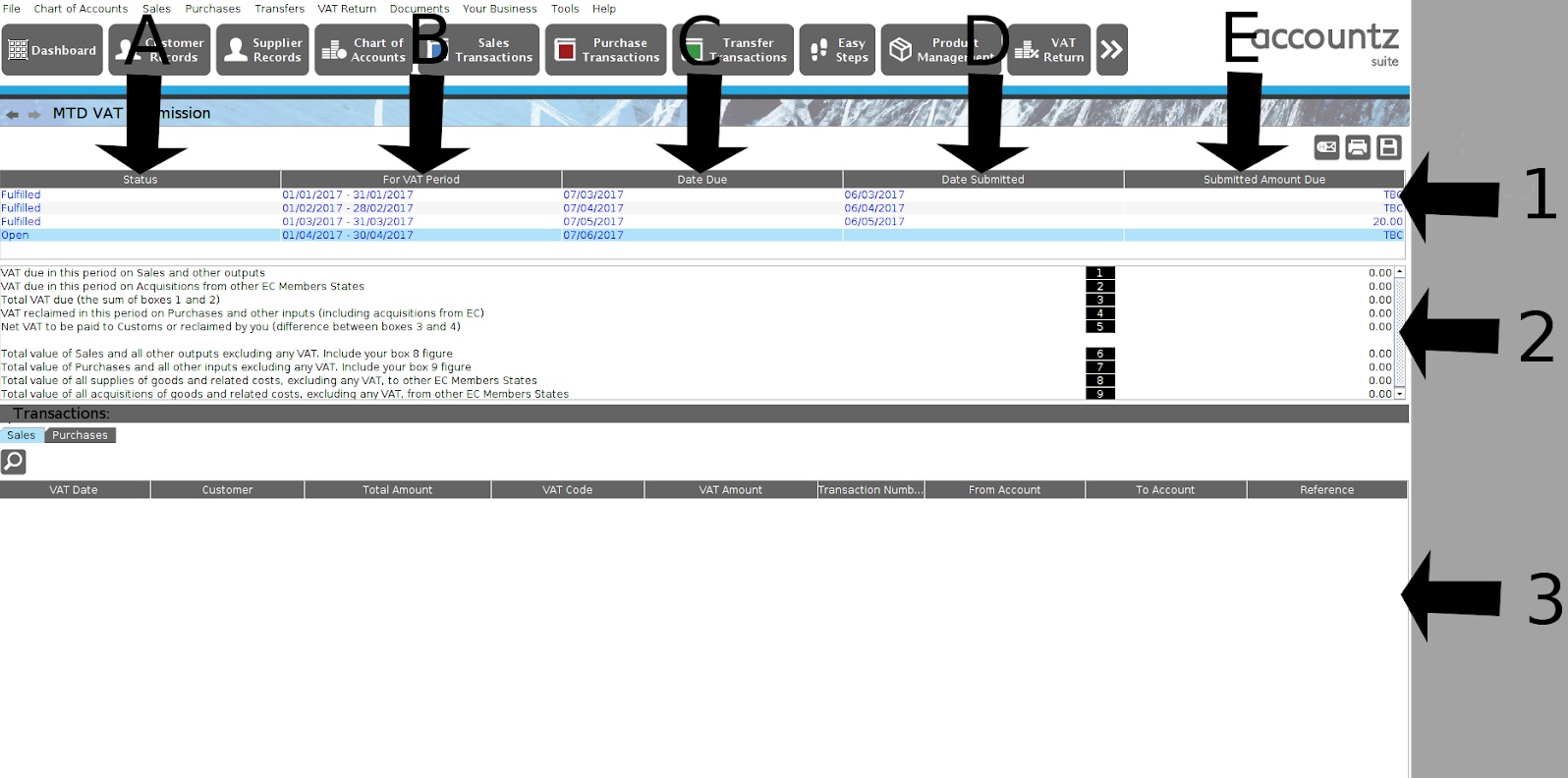

Once the setup is completed you will see the full MTD component as set out below.

1.Section list:

A)-Status - This shows either ‘Open’ or ‘Fulfilled’ returns

B)-For VAT period - The date range for the period/obligation

C)-Date Due - The latest date the period must be submitted by

D)-Date Submitted - The date the period was submitted (for ‘Fulfilled’ periods)

E)-Submitted Amount Due - The net tax due to HMRC for the period

2.Lists the figures for the boxes 1 to 9 for the currently selected period - For ‘Fulfilled’ periods these figures are what HMRC reports were submitted (not calculated by Business Accountz from the transactions). For ‘Open’ periods these figures are the calculated figures from the transactions in Business Accountz.

3.This section shows the sales and purchase transactions for the currently selected period. These transactions are always those that are currently in Business Accountz.

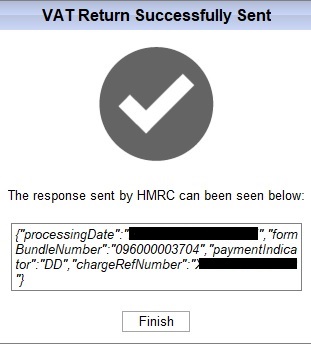

Once the submission has been made the transactions will be locked.

Any changes that need to be made after submission can be made with adjustment entries see here or contact support@accountz.com for help with this.

Submission Process

When you are ready to submit a VAT return, select the desired period from section ‘1’ of the MTD for VAT component and then press the submission button above the table. As seen here:

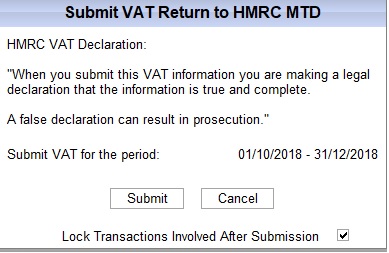

Under normal submission circumstances of an ‘Open’ period (or after user confirms they wish to resubmit a ‘Fulfilled’ return) they will see the submission overview popup.

When the user presses the ‘Submit’ button they will see a “Please wait” message in the pop-up window.

On receipt of a success message from HMRC the user will be presented with the following:

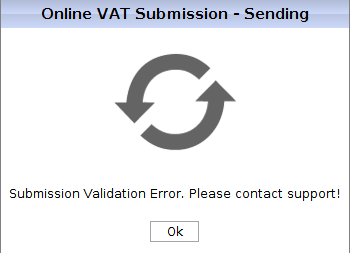

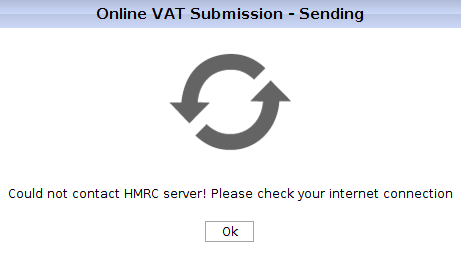

If HMRC sends a failure one of the following will be displayed (depending on the error):

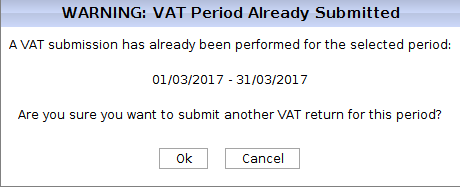

If a period is selected that has already been ‘Fulfilled’ the following pop-up appears to confirm you wish to re-submit.

If you press OK, HMRC will return a message stating there is an error. Re-submissions should not be completed, adjustments should be entered for the next period.

FAQ

- The MTD page is blank. Why?

MTD page not appearing is due to a port setting issue. The default port is and should be 8888 for HMRC MTD for VAT submissions. If it needs to be set, this can be done in About > Arguments

- If I cancel the subscription will I still be able to view the MTD submissions?

No, once the program goes into read only, no calls (no connection) can be made to HMRC so all MTD history will be lost from within Business Accountz. You may be able to login to HMRC directly to view submissions or the new program you are moving to may import this data.* You will need to check this with HMRC directly.

- Will MTD Submissions appear in BAZ if they are moving from another program?

It is too early for us to know this at the moment as MTD has only just been released.