VAT Corrections

There are many reasons why you may need to correct a previous transaction for a VAT error. Below are all the cases and the solutions. We assume a VAT rate of 20% for all examples.

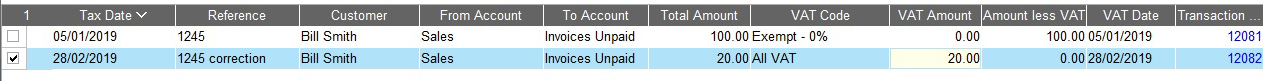

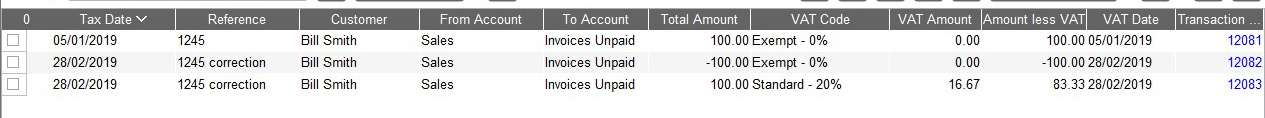

SALES

- Sale of 100 entered with exempt VAT, subsequently discovered that VAT of 20 should have been added. The VAT is billed to the customer at a later date.

- Sale of 100 with exempt VAT, subsequently discovered that VAT of 20% should have been added. The extra 20% is NOT billed to the customer.

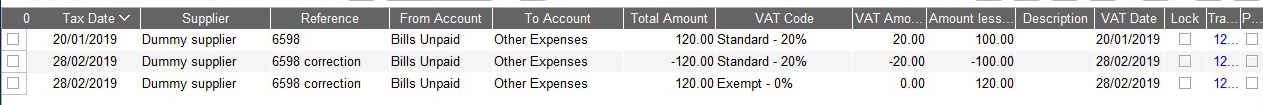

PURCHASES

- Purchase of 120 with exempt VAT. Subsequently discovered that VAT of 20% could have been reclaimed.

- Purchase of 120 entered with Standard VAT should be exempt.

For all above examples, if the VAT refers to a different VAT period than the original, edit the VAT Date for the current VAT period. Remember to press the Enter key to confirm all changes.

Of course if the change is for the current period, you can simply edit the transaction directly.