Handling part payments with VAT Cash Accounting Scheme

If you are on the UK VAT Cash Accounting Scheme (whereby you only account for VAT when invoices and purchases are actually paid for) then you will need to follow this procedure.

You will need to split the original invoice or receipt into multiple transactions.

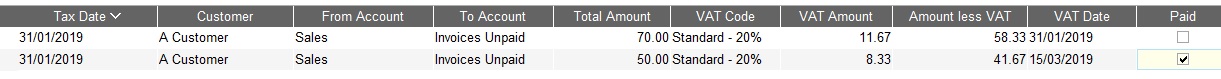

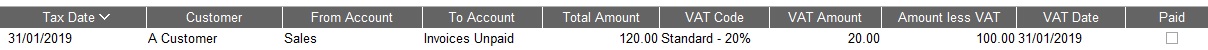

Example Original transaction for 120.00 including VAT

An amount of 50 is paid towards this. The original invoice is split into 2 transactions. The 50 is entered as a Transfer From Invoices Unpaid to Bank and the split part of the invoice is marked as paid checking the VAT date agrees to the payment date.

If the customer does not pay off the second part in full, then it will need splitting again into a third transaction.